Investment Strategy Brief

Trump 2.0: Regulation

Reprieve

February 23, 2025

Executive Summary

- Despite concerns and uncertainty surrounding tariffs, business sentiment has turned more optimistic.

- The administration has frozen new regulations, returning, in that respect, to a more business friendly approach.

- The perception of less regulation should make businesses more willing to expand their operations and drive economic growth.

- Reduced regulation should benefit small cap firms more than their larger counterparts.

- Deregulation may be an economic tailwind, particularly for small cap companies that bear the brunt of regulatory compliance.

Small business sentiment has been more optimistic in anticipation of deregulation

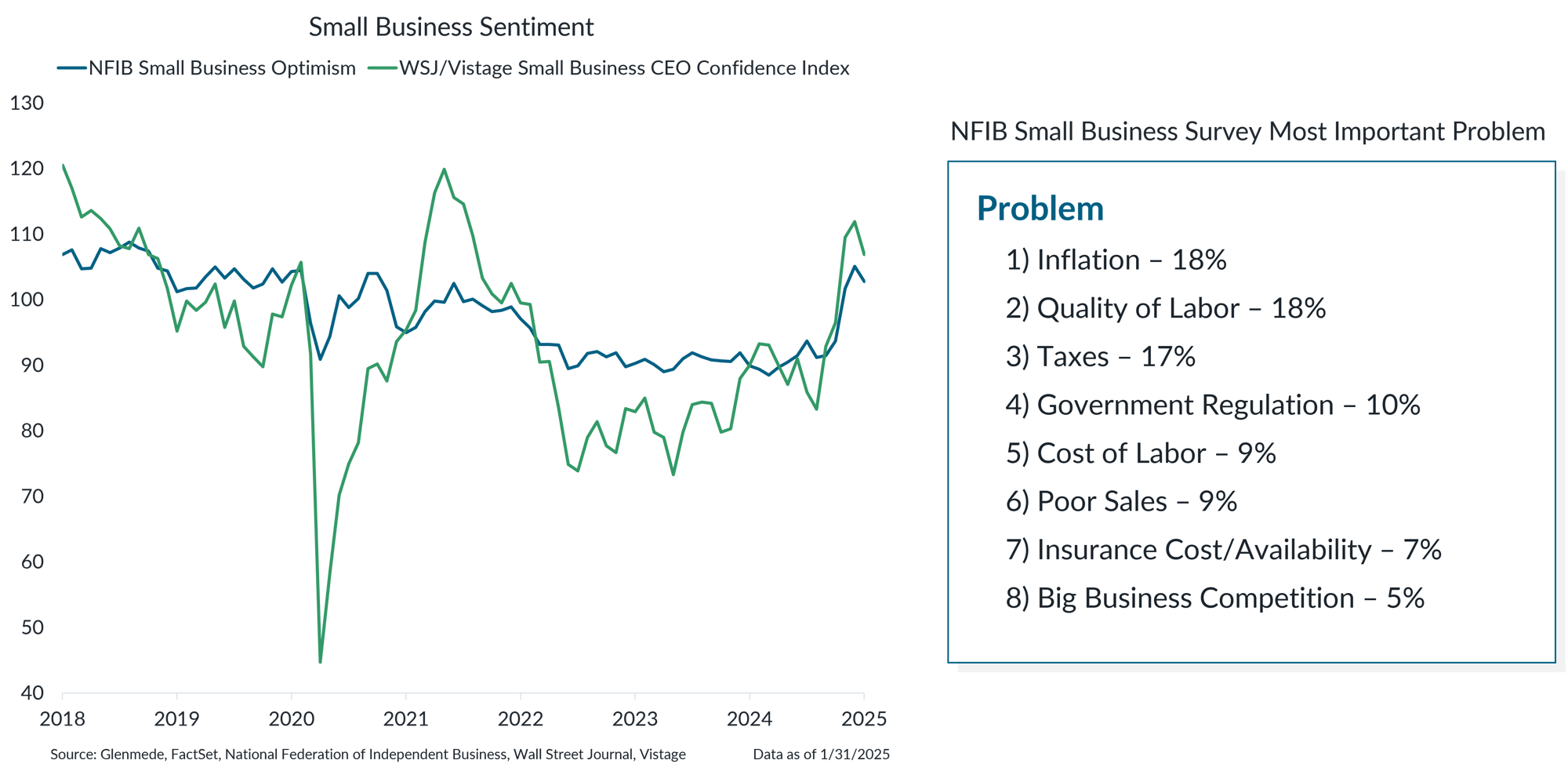

Shown in the left panel is the National Federation of Independent Business Small Business Optimism Index, which is a survey-based measure that reflects the degree of optimism expressed by small business owners regarding their economic outlook and the Wall Street Journal (WSJ)/Vistage Small Business CEO Confidence Index. Data in the right are the results of the National Federation of Independent Business (NFIB) monthly Small Business Economic Trends survey, which asks respondents to identify the number one problem facing their business.

- Small business confidence has increased significantly post-election as the new administration is set to tackle regulation, which is frequently cited as a top concern for businesses.

- With pre-election political uncertainty in the rearview mirror, an increasing share of businesses believe that now is a good time to expand.

The administration has frozen new regulations, returning to a more business-friendly approach

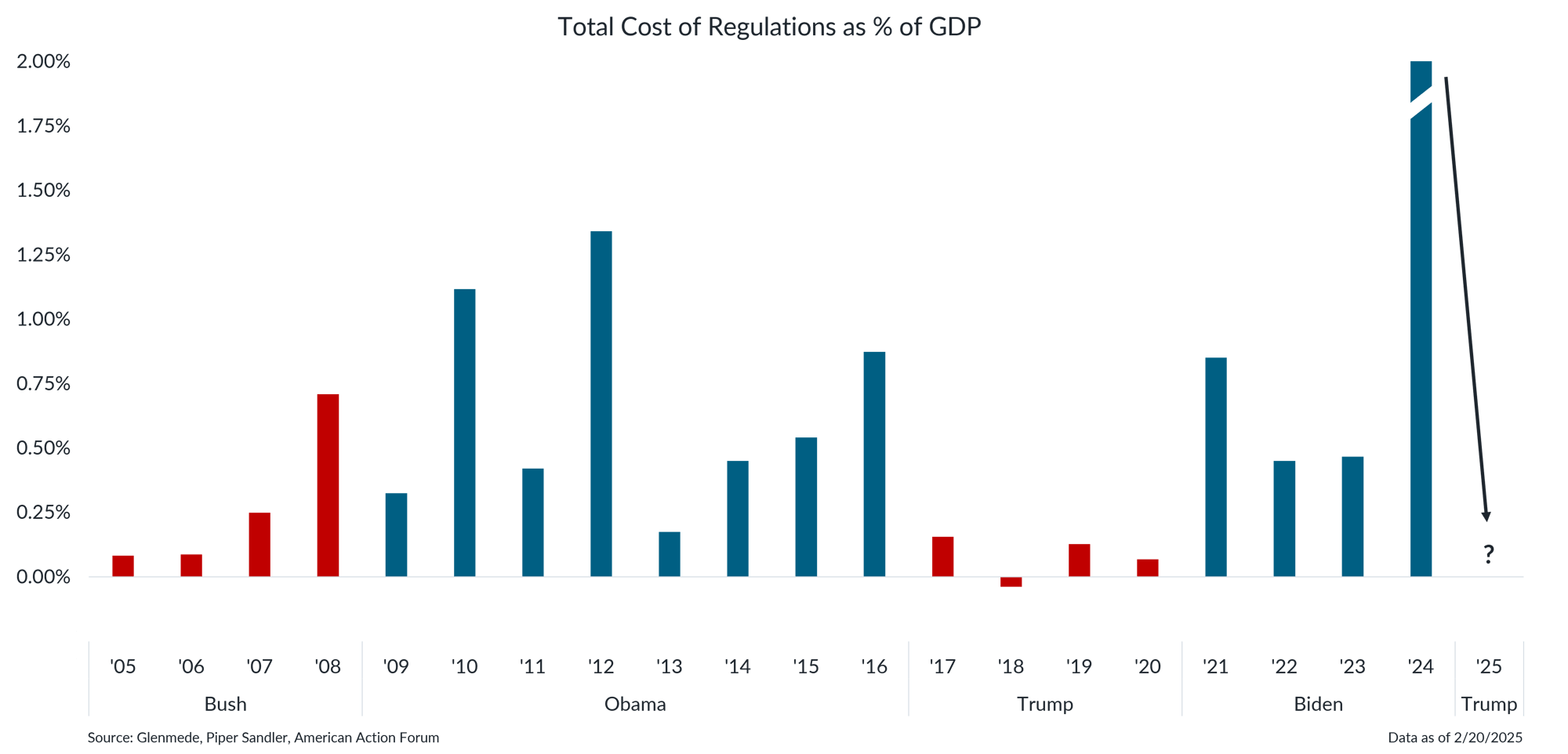

Data shown represent the estimated cost of new regulations as a % of GDP by year and grouped by presidential administration. The data point for ’24 is 4.8%, but the bar uses an axis break for visual purposes. American Action Forum is an independent, non-profit organization and is not formally affiliated with or controlled by any political group but may not be a completely unbiased source as it was established to promote “center-right” economic and fiscal policy. The use of its data should in no way be construed as an endorsement of the group’s political leaning, policy preferences or accuracy of estimates.

- Businesses perceive most regulations, independent of the purpose, as a cost to their operations, reducing efficiency and their appetite for business growth.

- The new administration has already ordered a freeze on new regulations, which may be a notable tailwind for economic growth and corporate profits.

Reduced regulation should benefit small cap firms most

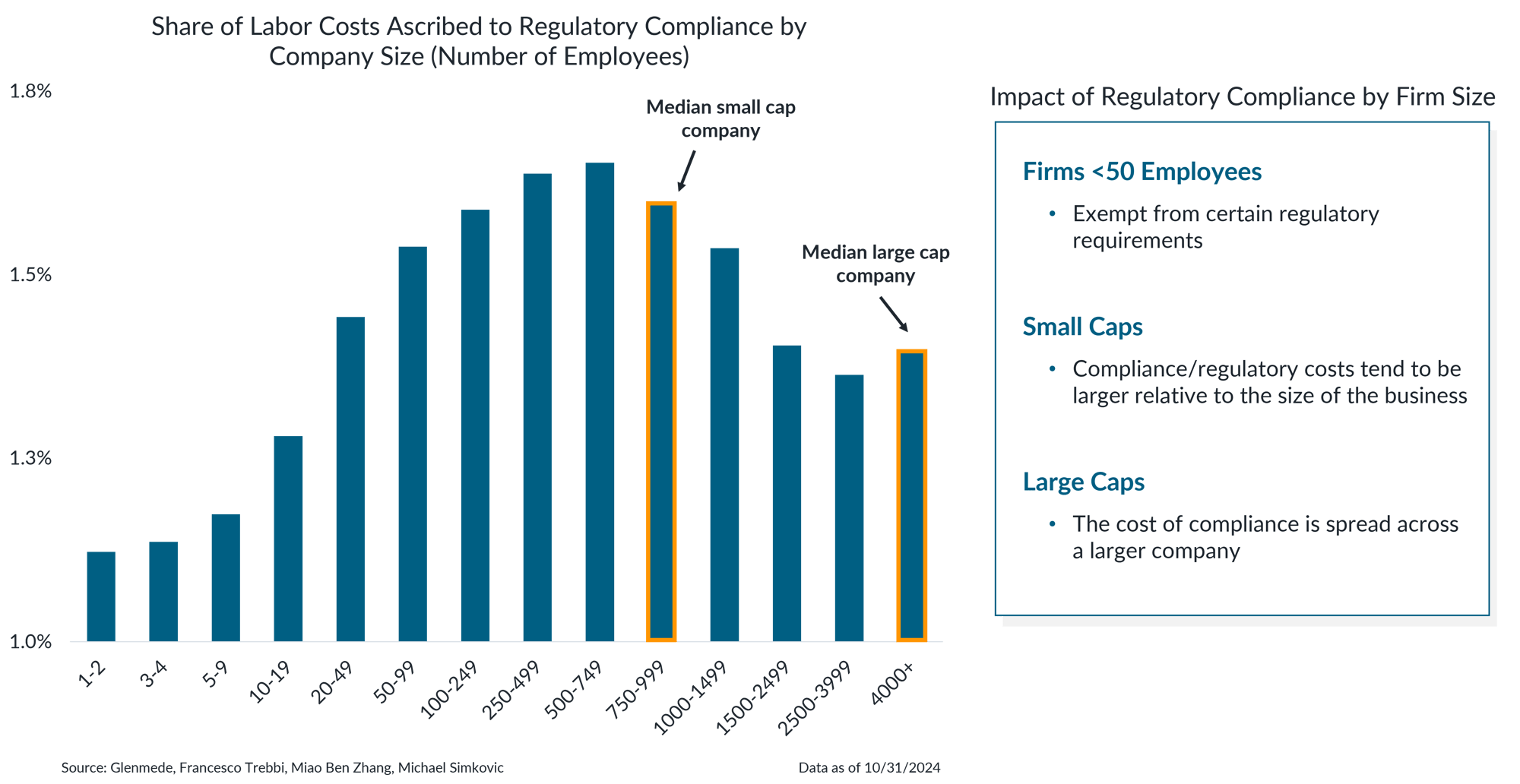

Data shown in the left panel represent the share of labor costs ascribed to regulatory compliance by company size, as measured by the number of employees per establishment.

- Smaller owner-operated businesses are exempt from certain regulatory requirements and larger firms benefit from spreading regulatory costs across greater economies of scale. In comparison, small cap companies often face the highest regulatory costs relative to their size.

- Deregulation may be an economic tailwind, particularly for small cap companies that bear the brunt of regulatory compliance.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.