Investment Strategy Brief

Watching for Cockroaches in Debt Markets

November 30, 2025

Executive Summary

- Stress in auto lending may be the first “cockroach,” warranting vigilance for additional lurking debt issues.

- Other issues may reside in private credit, where covenant-lite and payment-in-kind structures are making credit risks harder to spot.

- AI hyperscalers are increasingly using debt and special purpose vehicles (SPVs) to finance capital expenditures.

- Real-time market measures do not currently show system-wide financial stress, but should be monitored.

- Investors should continue to monitor lending-channels as a key dimension of risk heading into 2026.

Stress in auto lending may be the first “cockroach,” warranting vigilance for additional lurking debt issues

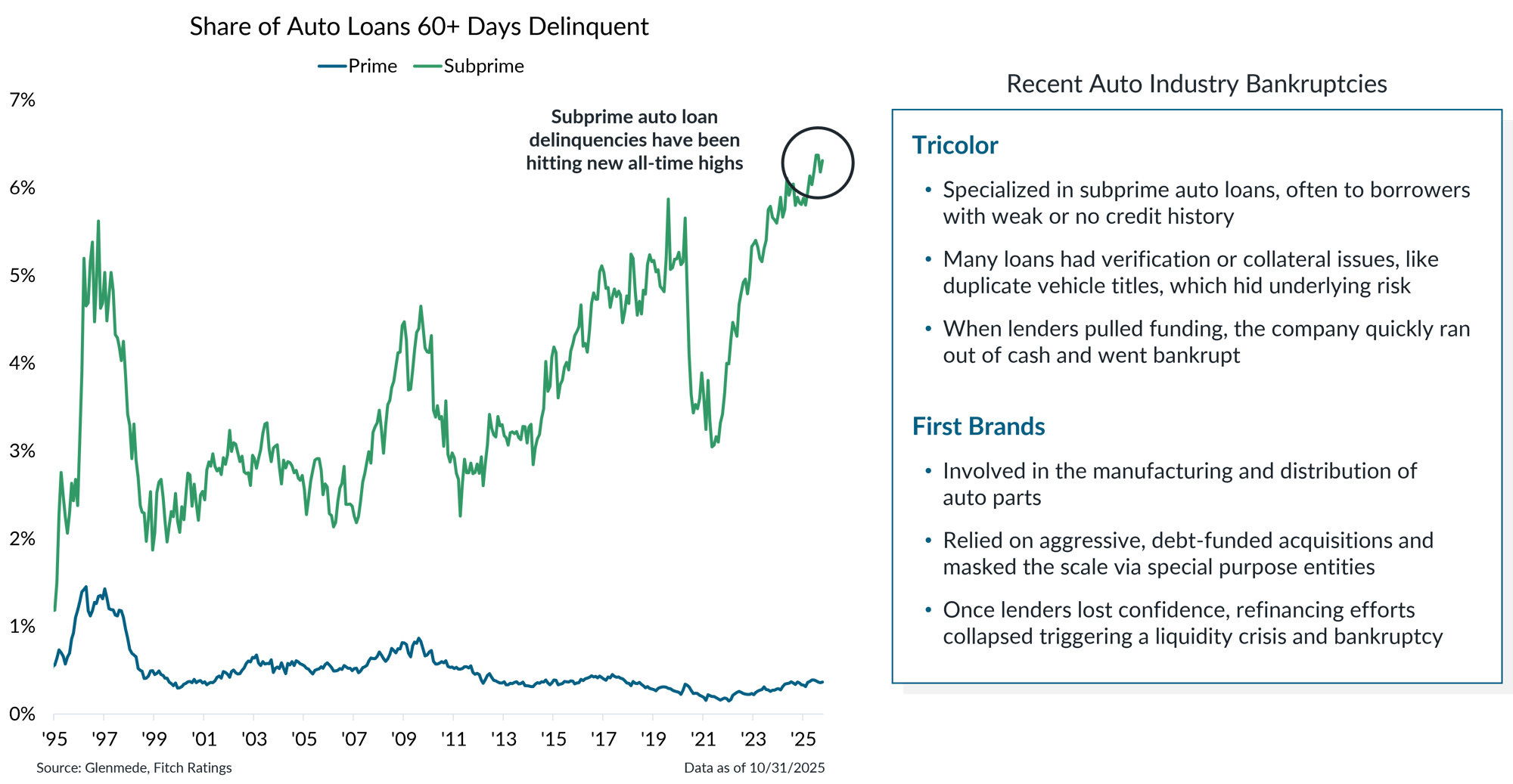

Data shown are the share of outstanding auto loans (prime borrowers in blue, subprime borrowers in green) that are 60 days or more delinquent on payments, shown on a seasonally adjusted basis.

- Subprime auto delinquencies have recently been hitting new all-time highs, which was a contributing factor to the recent high profile bankruptcy of Tricolor, which specialized in loans to borrowers with weak credit history.

- Much like an invasive pest scurrying across the floor, when debt problems surface it is often a signal that more may be hidden out of sight. This is a reminder that investors must remain vigilant for emerging risks.

Other issues may reside in private credit, which has driven speculative-grade lending over the last decade

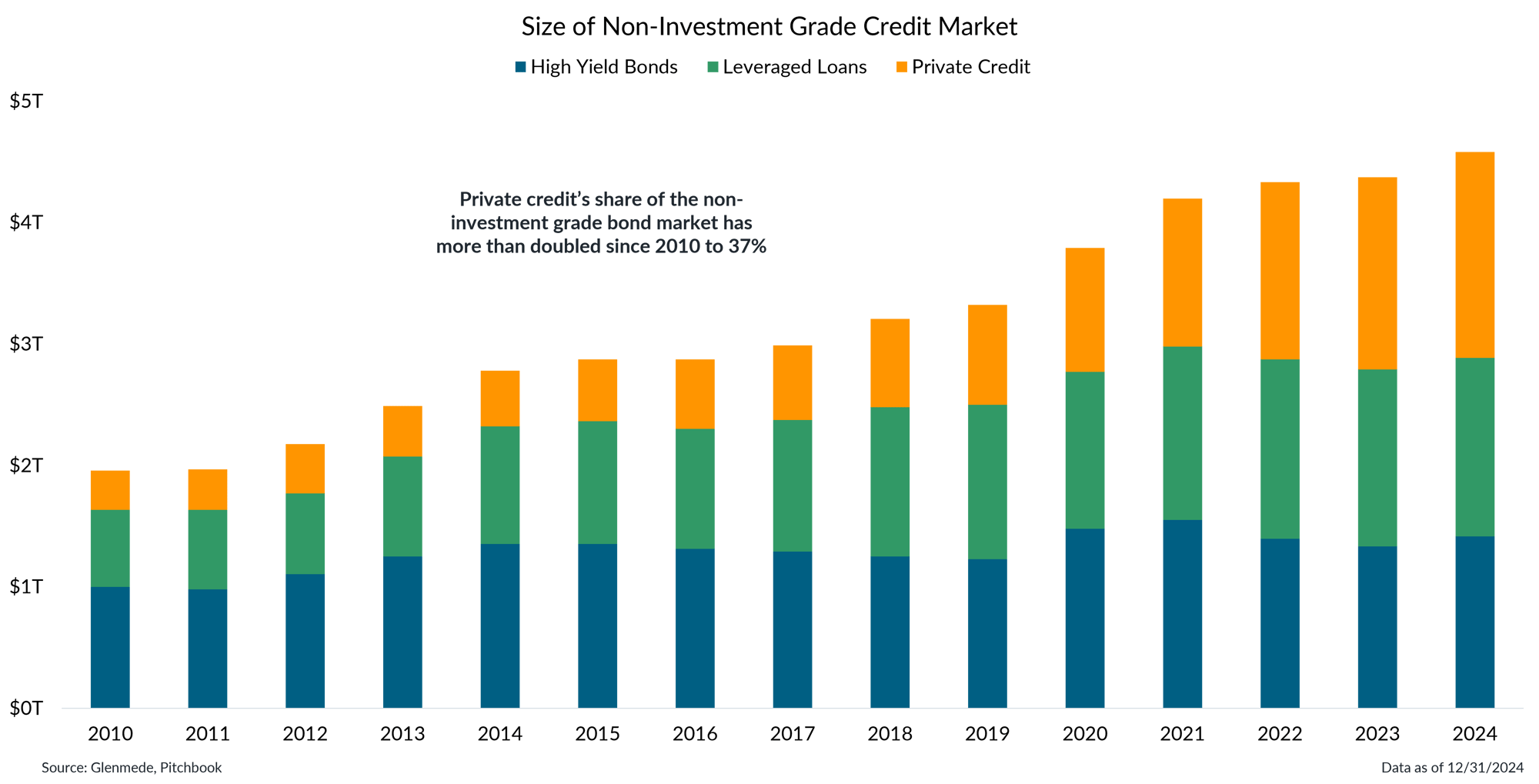

Data shown represent the size of outstanding debt obligations in the U.S., in trillions of U.S. dollars, for various portions of the non-investment grade credit market.

- Private credit expanded rapidly in the 2010s, as very low interest rates and post-2008 regulations that tightened bank capital and lending standards created fertile ground for nonbank lenders to grow.

- The rapid expansion in private credit has pushed more speculative-grade lending into opaque structures, making it incrementally more difficult to identify underlying borrower stress.

Eroding traditional safeguards and payment-in-kind structures are making private credit risks harder to spot

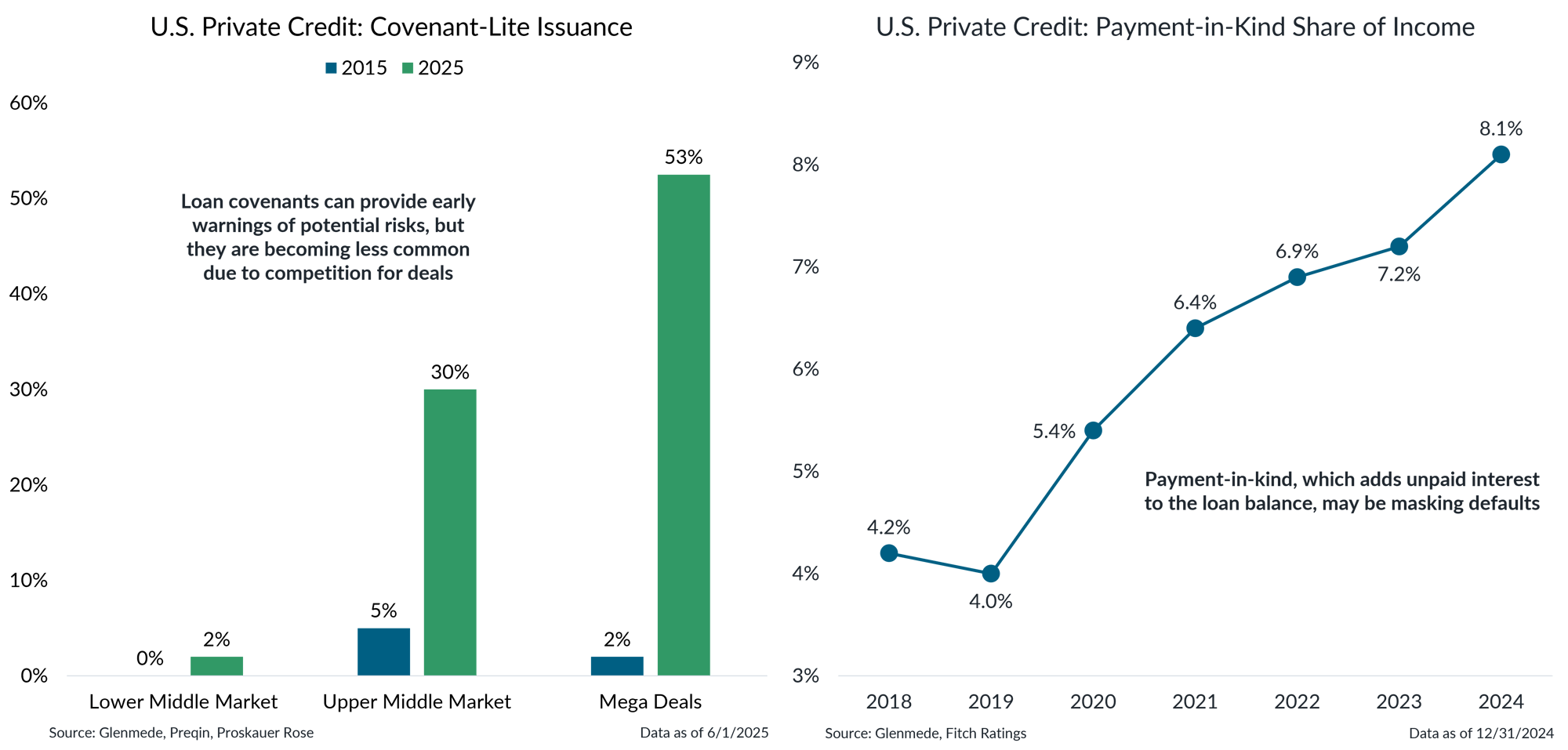

Shown in the left panel are the shares of new private credit issuance classified as covenant-lite, defined by those that lack one clear financial maintenance covenant such as leverage or interest coverage ratios. Each group is defined by the following: Lower Middle Market (less than $25 million in borrower EBITDA), Upper Middle Market (greater than $50 million in borrower EBITDA) and Mega Deals (greater than $500 million in borrower total debt). EBITDA refers to earnings before interest, taxes, depreciation, and amortization. Shown in the right panel is payment-in-kind income as a percentage of interest and dividend income for business development companies rated by Fitch.

- As more capital has flowed into private credit, with more dollars chasing a limited set of lending opportunities, borrowers have been able to secure increasingly favorable terms on their loans.

- One such example is the increased prevalence of covenant-lite structures, which weaken early-warning signals meant to detect deterioration in a borrower’s fundamentals.

- In addition, payment-in-kind financing, which allows borrowers to tack on unpaid interest to their loan balances, may be artificially depressing default rates in private credit.

AI hyperscalers are increasingly using debt and special purpose vehicles to finance capex

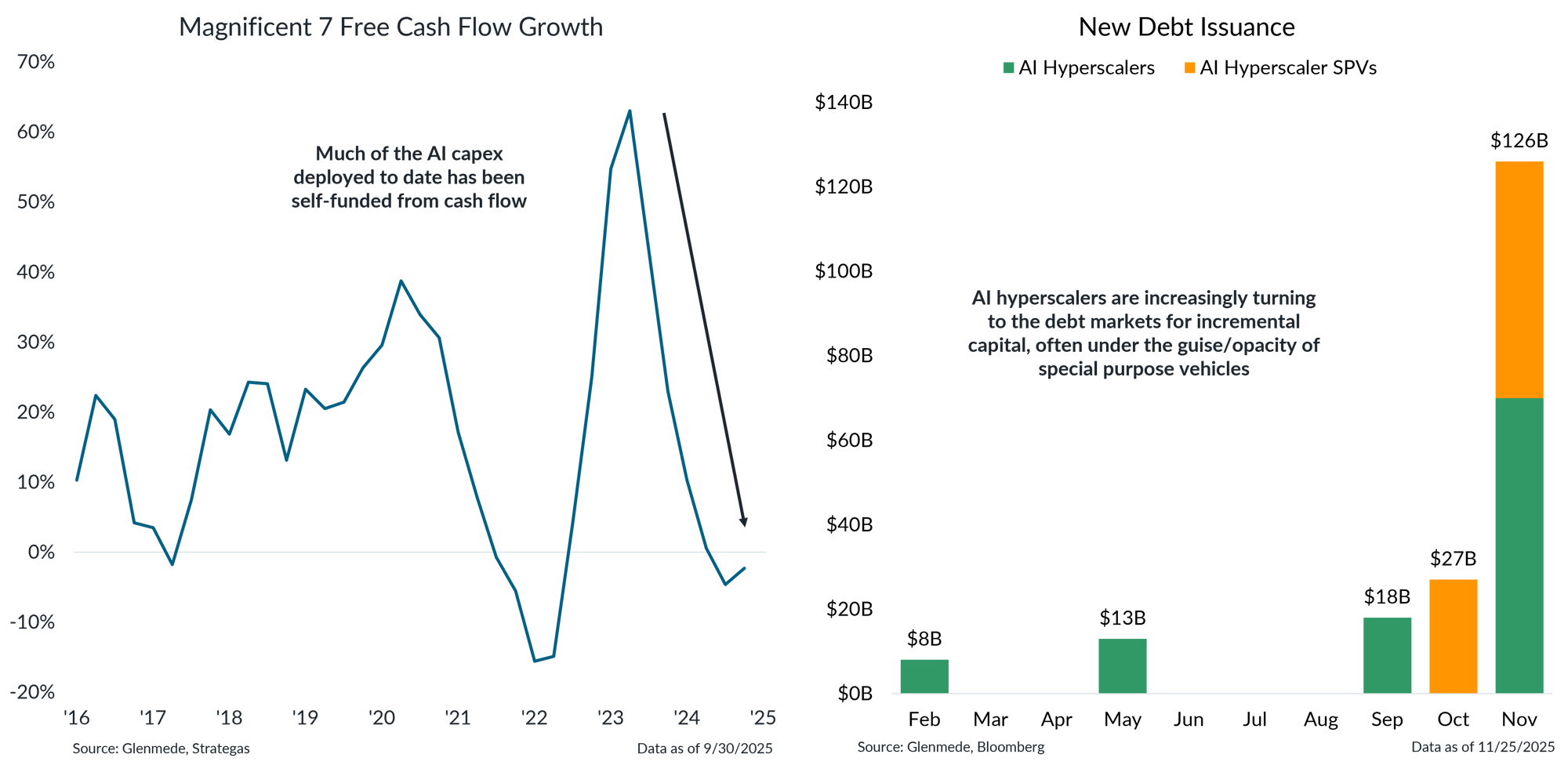

Shown in the left panel is the year-over-year percentage change in free cash flow for the Magnificent 7 (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla). Shown in the right panel is the monthly amount of new debt issuance from the AI Hyperscalers (Alphabet, Oracle, Amazon, Meta), in billions of U.S. dollars. Green figures represent direct issuance from the companies themselves, and orange figures represent indirect issuance via special purpose vehicles (SPVs), subsidiaries, or partner companies that are raising debt guaranteed by the AI Hyperscalers. November figures include pending loan packages.

- Up until relatively recently, much of the capital needed to finance the buildout of AI capex had been largely self-funded. However, hyperscalers are increasingly relying on external financing as free cash flow growth has flatlined.

- The growing use of SPVs to intermediate this borrowing adds opacity to the true pace of leverage buildup, complicating efforts to assess how much balance sheet risk is accumulating beneath the surface.

Real-time market measures do not currently show system-wide financial stress, but should be monitored

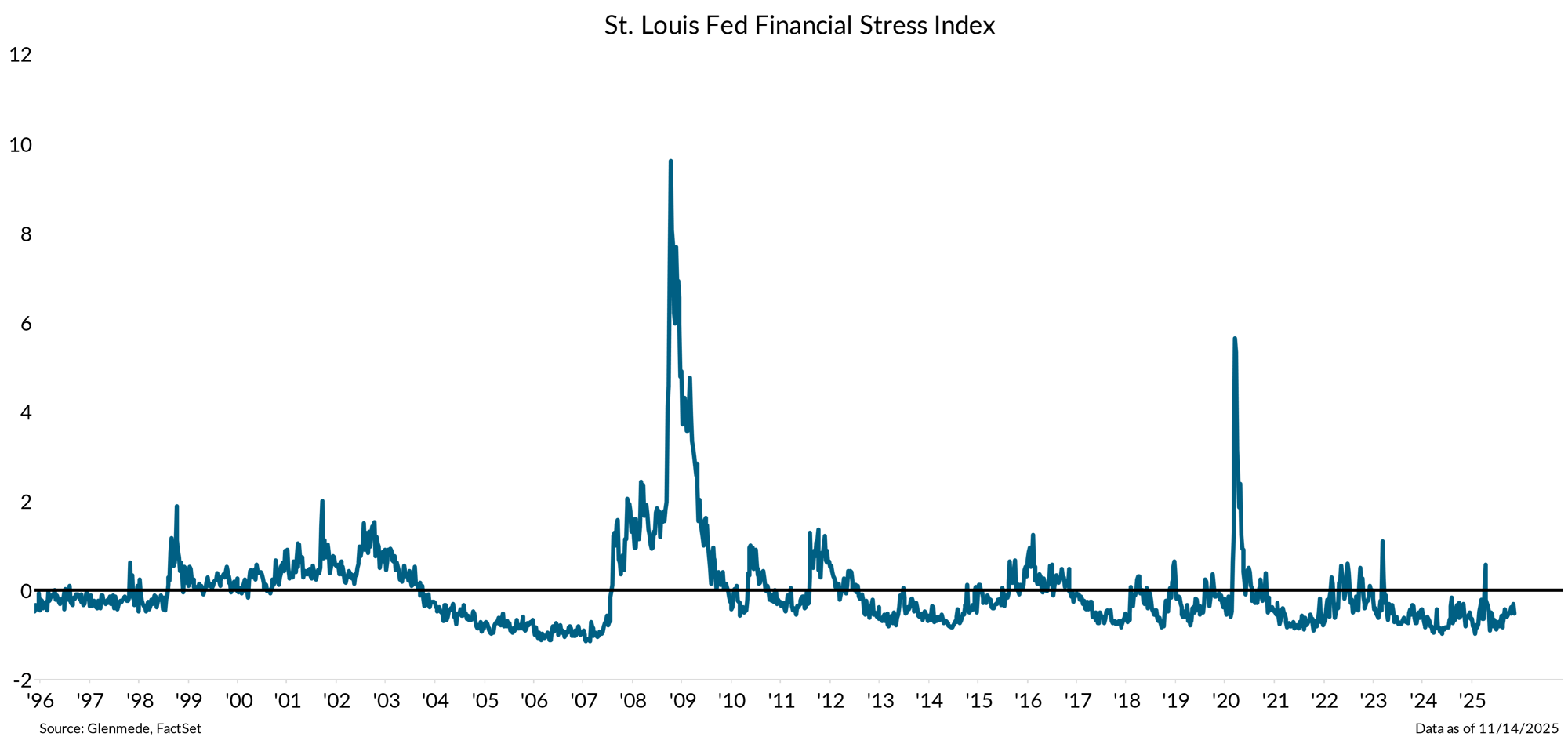

The data shown are the output of a composite indicator of aggregate stress in the U.S. financial system. The index is constructed from 18 weekly data series seven interest rate series, six yield spreads, and five other indicators. The index is constructed so its long-run average equals zero and represents normal financial conditions. Values below zero imply below-average stress, and values above zero imply above-average stress. The y-axis values represent the number of standard deviations (z-score) from normal conditions.

- The St. Louis Fed Financial Stress Index remains below long-term averages, indicating that current market conditions are not flashing broad systemic risk.

- However, historical spikes, such as 2008 and 2020, show how quickly stress can escalate, underscoring the importance of monitoring real-time indicators even when headline measures appear stable.

This material is provided solely for informational and/or educational purposes and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Any company, fund or security referenced herein is provided solely for illustrative purposes and should not be construed as a recommendation to buy, hold or sell it. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.