Investment Strategy Brief

Winds Shift, but the Dollar Holds Course

June 15, 2025

Executive Summary

-

Concerns about the dollar’s demise (i.e., displacement as the reserve currency) are nothing new.

-

The dollar’s reserve currency status comes from its size, liquidity, transparency, political stability and ease of transaction.

-

The dollar has a dominant position in foreign transactions and global reserves but is gradually sharing its position on the world stage.

-

Consensus expectations are for the dollar to gradually depreciate, but not for it to lose its reserve status.

-

While the dollar is unlikely to be dethroned as the leading reserve currency, further weakness can be a tailwind for international equities.

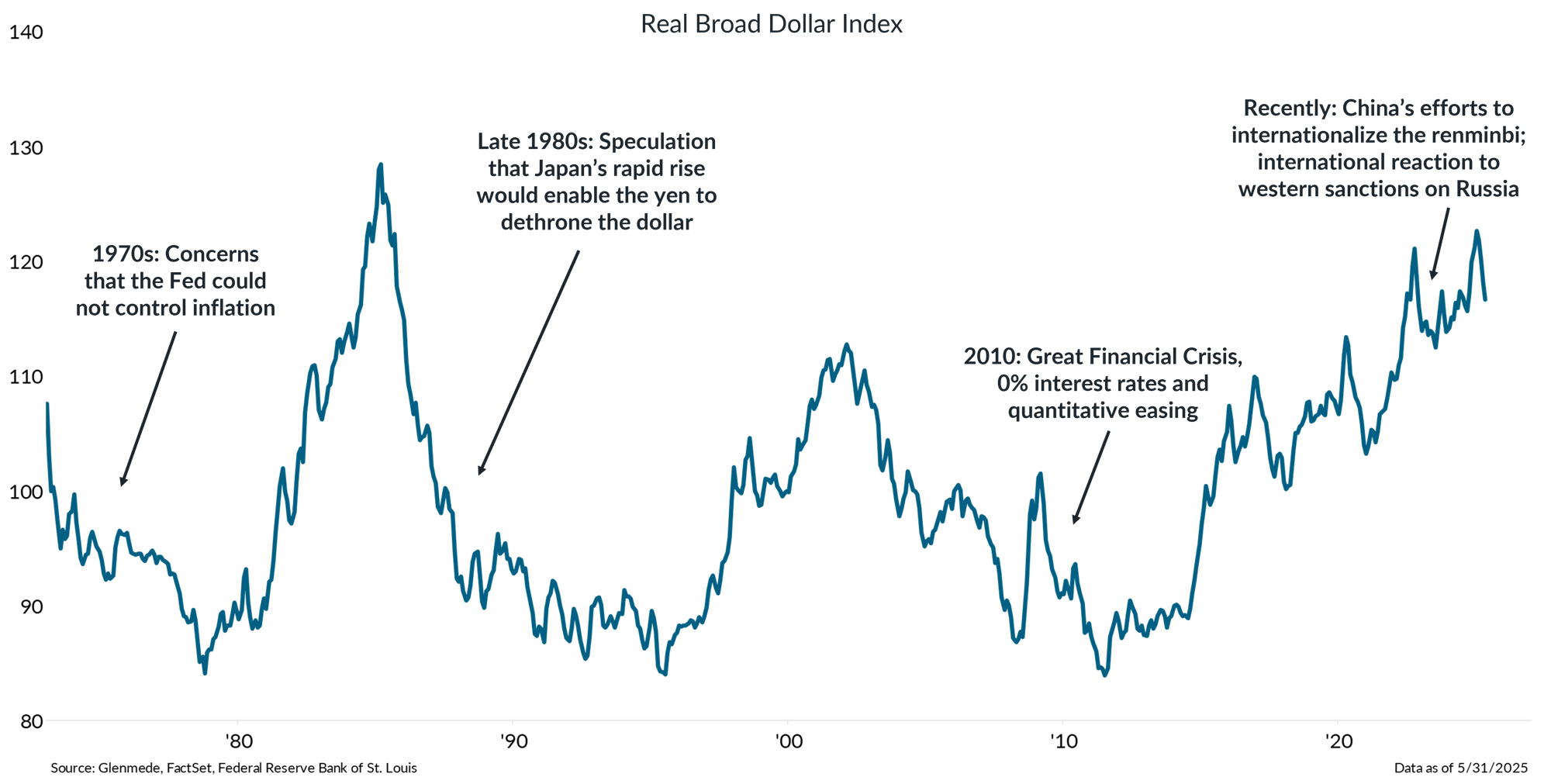

Arguments for the dollar’s demise are not new

Data shown are weighted averages of the foreign exchange value of the U.S dollar against the currencies of a broad group of major and emerging-market currencies, adjusted for inflation to account for purchasing power differentials, indexed to 100 in January 2006.

-

There have been multiple concerns in recent history about whether the dollar will keep its status as the world’s reserve currency, but it has yet to be dethroned.

-

Recent policy shifts by the new administration, along with concerns about the sustainability of U.S. government debt, have fueled debates about the potential decline of the dollar.

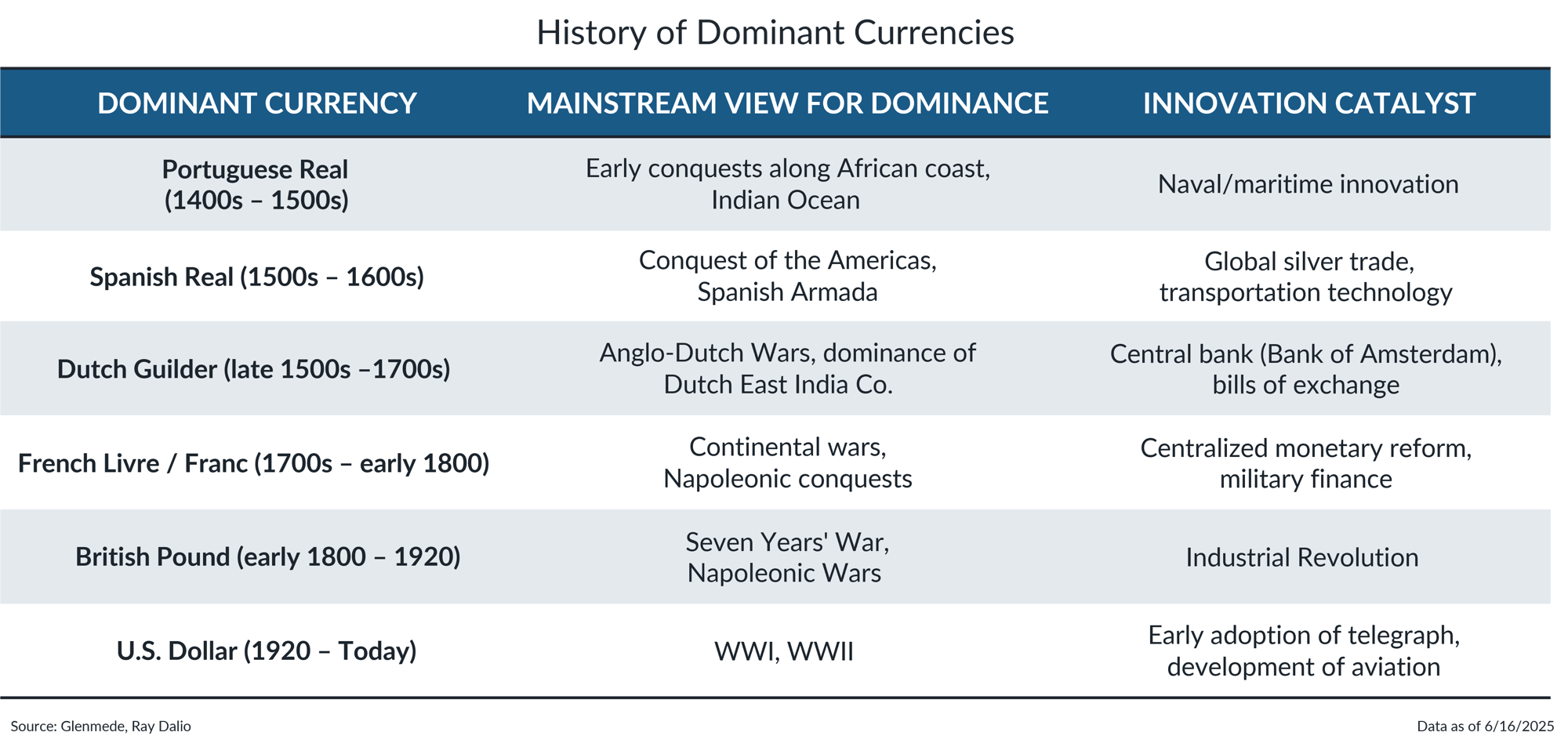

It takes more than conflict to unseat a dominant currency

Shown is a general overview of the evolution of global reserve currencies throughout recent history. Date ranges are approximate and reflect periods of peak influence rather than strict start and end points. Several currencies coexisted during periods of overlapping influence and dominance often depended on geography, trade routes and political power.

-

Historically, reserve currencies like the Dutch guilder, the British pound and now the U.S. dollar have retained their dominance for extended periods, often lasting well over a century.

-

The enduring status of dominant currencies is typically supported by a resilient financial system, a strong economy and a broad perception of safety and credibility.

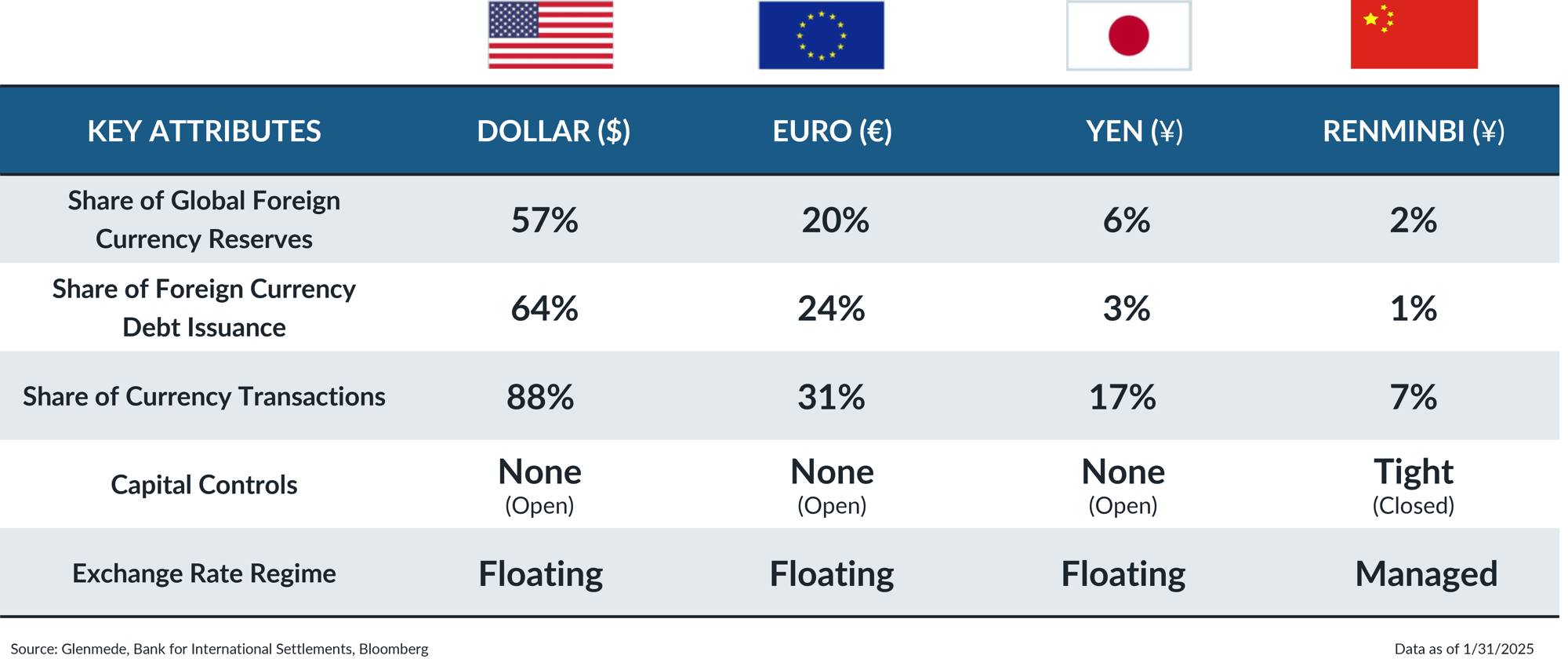

The U.S. dollar continues to dominate global finance

Share of global foreign currency reserves are assets denominated in a foreign currency that are held by a nation's central bank or other monetary authorities. Share of foreign currency debt issuance is debt issued by countries in a currency other than that of their home country. Share of currency transactions reflects thep ercentage of international currency transactions in which each respective currency is on one side of the transaction. The Chinese currency can be referred to interchangeably as the renminbi or the yuan.

-

The U.S. dollar continues to dominate global finance, leading all other major currencies in share of reserves, foreign debt issuance and currency transactions.

-

Other factors contributing to the dollar’s dominance are U.S. political and economic stability, providing a strong backing and the element of transparency to the currency.

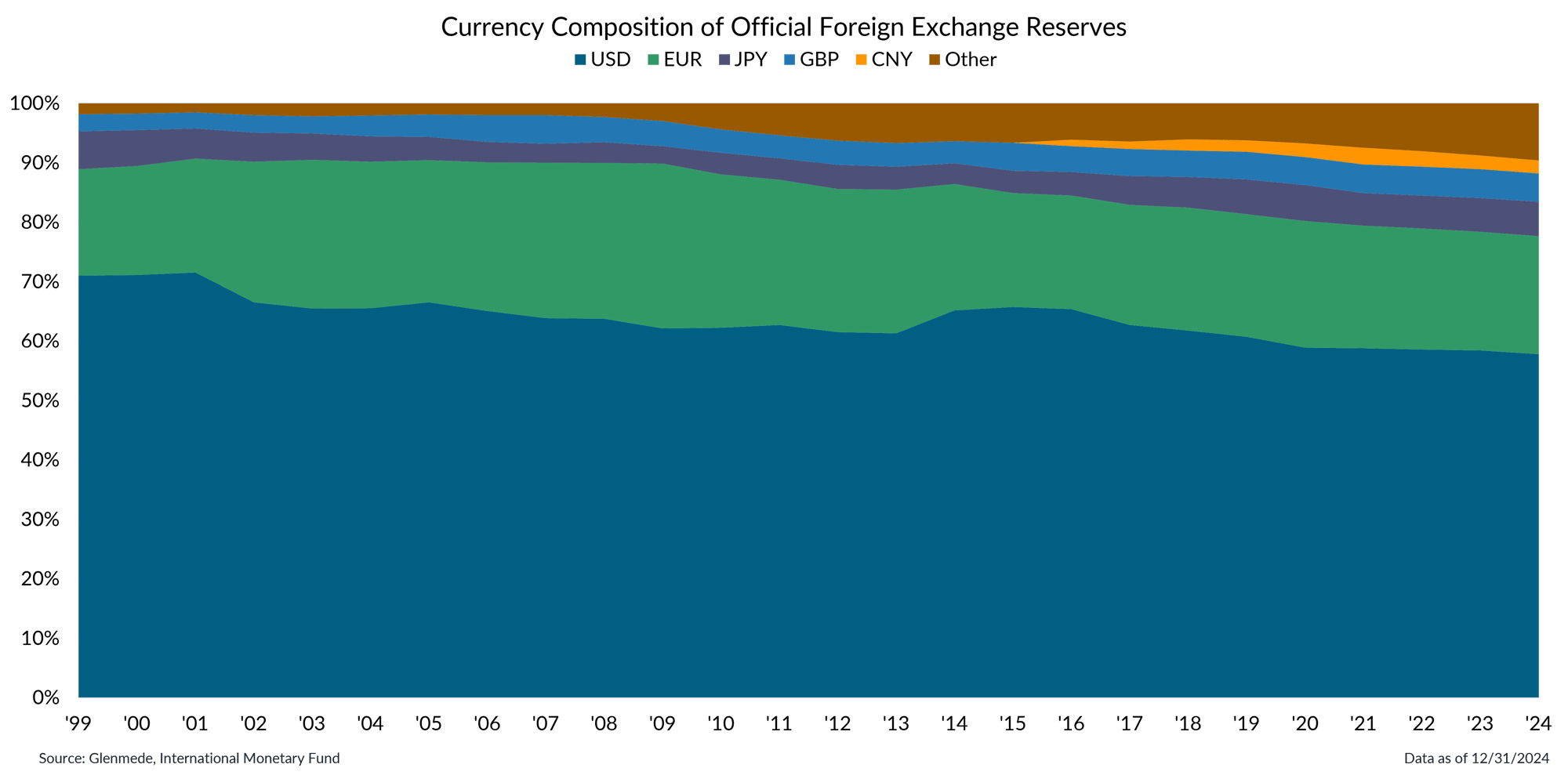

The dollar may be sharing the reserve stage, but it does not appear close to losing its leadership

Data shown are the currency compositions of official foreign exchange reserves since 1999: U.S. dollar (USD), Euro (EUR), Chi nese yuan (CNY), Japanese yen (JPY), British pound (GBP) and Other, which includes the Australian dollar (AUD), Canadian dollar (CAD), Swiss franc (CHF) and other currencies.

-

Despite ongoing discussions about its decline, the U.S. dollar accounts for roughly 60% of global foreign exchange reserves, underscoring its continued dominance.

-

While the euro and yuan may be starting to enter the margins of the ongoing global reserve currency discussion, the U.S. dollar remains firmly at the center of the international financial system.

Further dollar weakness could be a tailwind for international equities

.png?width=2000&height=974&name=IS%20Brief%202025-06-16%20Chart%205%20(1).png)

Shown in the left panel is the U.S. Dollar Index (DXY), which measures the value of the U.S. dollar relative to a weighted basket of major foreign currencies. The gray area shown is the range of analyst projections through the end of the second quarter in 2026. Shown in the right panel is the annualized performance of U.S. Large Cap (S&P 500® Index), U.S. Small Cap (Russell 2000® Index) and International (MSCI All Country World ex-U.S., backfilled prior to 1988 with the MSCI EAFE Index) equities since 1973 in blue, and the performance of each over the same period including only the months when the U.S. dollar was weakening in green. Past performance may not be indicative of future results. One cannot invest directly in an index.

-

The median consensus of analysts’ projections for the U.S. dollar indicates that the relative value of the dollar is expected to continue falling against other major foreign currencies.

-

If the U.S. dollar continues to weaken, it may provide a meaningful tailwind for international equities.

This material is intended to review matters of possible interest to Glenmede Trust Company clients and friends and is not intended as personalized investment advice. When provided to a client, advice is based on the client’s unique circumstances and may differ substantially from any general recommendations, suggestions or other considerations included in this material. Any opinions, recommendations, expectations or projections herein are based on information available at the time of publication and may change thereafter. Information obtained from third-party sources is assumed to be reliable but may not be independently verified, and the accuracy thereof is not guaranteed. Outcomes (including performance) may differ materially from any expectations and projections noted herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss any matter discussed herein with their Glenmede representative.

Feature one

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature two

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.

Feature three

Use text and images to tell your company’s story. Explain what makes your product or service extraordinary.